Dal Blog di Validea Capital Management

An article in CFA Institute offers an overview of how Buffett’s Berkshire Hathaway has avoided many of the major pitfalls suffered by other “star” investors and how, from a factor-investing perspective, the conglomerate has managed to outperform for decades.

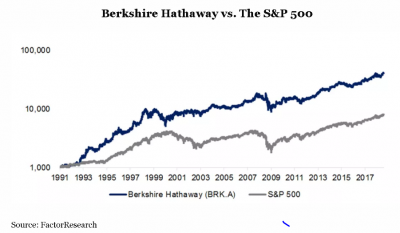

The article reports that Buffett’s “outperformance relative to the S&P 500 has been especially significant since 1991 and created immense value” for Berkshire shareholders. It adds that while there were some periods of underperformance, “these often turned out to be based on wise investment decisions that translated into superior returns later on.”

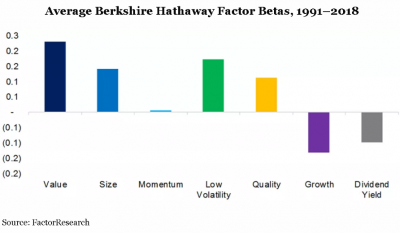

Based on a “factor exposure analysis” of Berkshire through a regression analysis of betas relative to common equity factors, the article said “a clear picture emerges: [Berkshire] had positive exposure to the Value, Size, Low Volatility and Quality factors as well as negative exposure to Growth and Dividend Yield.”

Continua a leggere sul Blog di Validea Capital Management